In the ever-evolving world of finance, savvy investors are constantly on the lookout for innovative opportunities to make their money work harder. The micro-investing revolution has brought a wave of possibilities, but what if you could step beyond the volatility of the stock market and explore the realm of ‘fixed income’ assets? Meet Blossom, your gateway to a new era of secure, high-yield investments.

1. What is Blossom and How Does It Work?

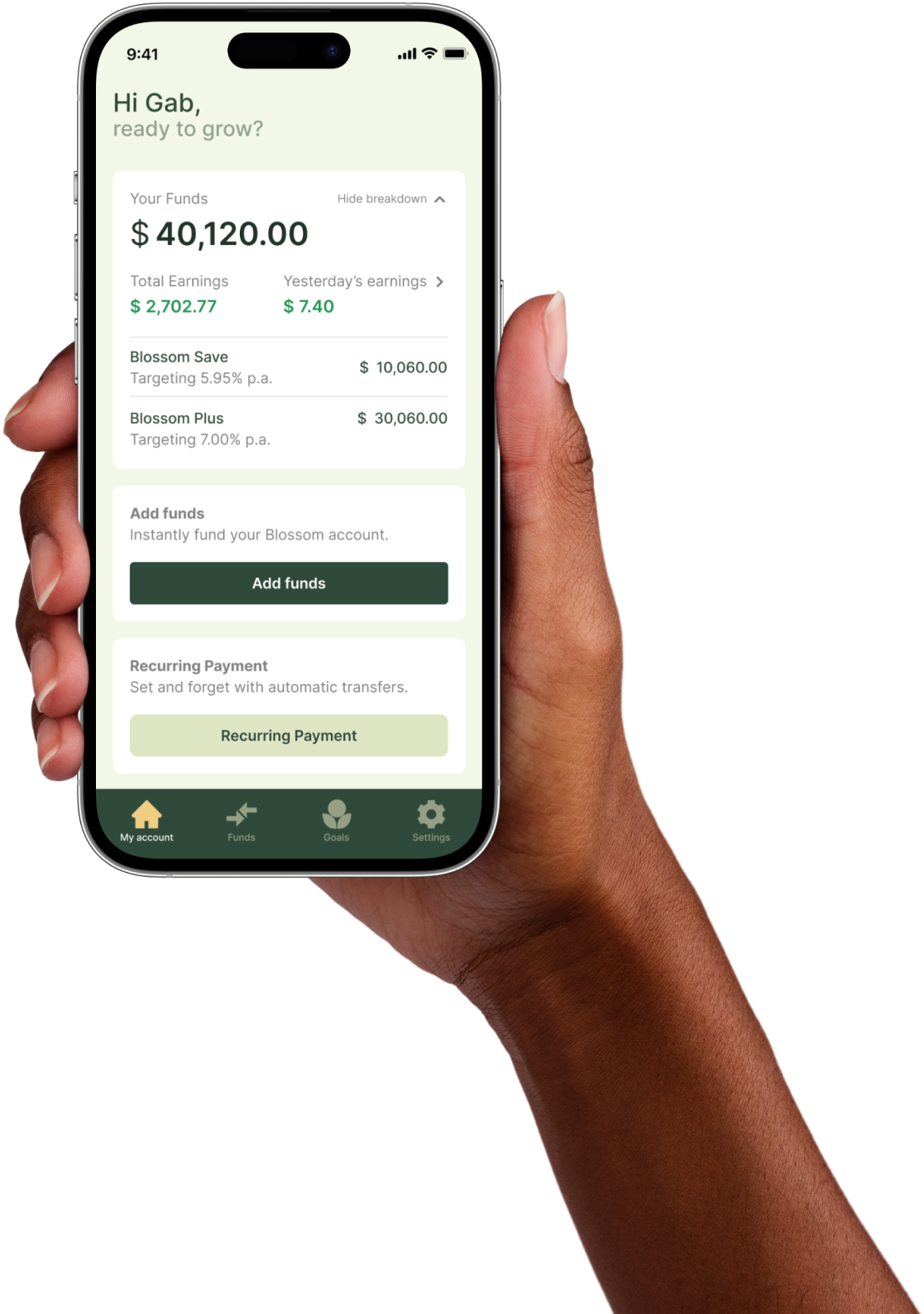

Imagine having the power to invest in ‘fixed income’ assets like corporate bonds, government bonds, and more, all with the goal of achieving a targeted return of 5.70% p.a. This is precisely what Blossom offers. Founded by visionary entrepreneur Gaby Rosenberg, backed by Gleneagle Asset Management, Blossom is on a mission to make fixed-income investments accessible to everyday Australians.

With Blossom, there are no complex deposit requirements or transaction hoops to jump through. It’s a breath of fresh air in a world where traditional savings accounts and term deposits can’t keep up with today’s financial demands.

2. How to Get Started with Blossom

An Easy Path to Financial Growth

Joining Blossom is a breeze. Here’s how:

- Sign up via the Blossom app or their website

- Link your bank account

- Deposit funds

- Let Blossom do the rest

Pro tip: Unlike some other investment platforms that demand your banking password, Blossom offers secure deposit methods like direct debit or PayID, ensuring your financial safety.

As of June 2023, Blossom boasts over 10,000 customers with $36 million in funds under management. The rapid growth underscores the platform’s popularity and potential.

3. Unpacking Blossom’s Fee Structure

Transparency and Affordability

Blossom keeps it simple with just one fee:

- 1% p.a. management fee

- Only charged after customers receive their 4% return

This fee structure is competitive compared to other investment options like micro-investing apps with brokerage or monthly fees, which can add up over time.

4. Is Blossom Safe?

Understanding the Risks

Important: Blossom is not your typical savings account or term deposit; it’s an investment vehicle that trades in ‘fixed income’ assets. While it offers the potential for a higher return, it’s essential to understand the risks involved.

Key safety features:

- Investments actively managed by Fortlake Asset Management

- Focus on investment-grade fixed income products

- Average portfolio rating of A

- Flexible withdrawals (can be requested at any time)

- Risk mitigation measures like the Threshold Management Agreement

5. Pros and Cons of Blossom

Balancing Risk and Reward

| Pros | Cons |

|---|---|

|

|

Conclusion: Empower Your Financial Future with Blossom

Unlocking Opportunities, Mitigating Risks

In the ever-evolving landscape of financial opportunities, Blossom stands as a beacon of possibility. Offering everyday Australians access to investments typically reserved for institutions and high-net-worth individuals, it strikes a balance between safety and growth.

With a targeted rate of return that outpaces many traditional options, Blossom empowers you to take control of your financial future. However, remember that all investments carry some level of risk, and it’s essential to do your research and understand the fine print.

Ready to embark on your journey of fixed-income investing?

Sign up for Blossom today through our exclusive affiliate link and discover a new era of financial growth.

Leave a Reply